One of the most important ways to promote financial stability is staying on top of how much money you’ve earned in the past year. Keeping track of this information will help you better understand your financial outlook and create an effective financial plan for the future.

YTD real check stubs are one method to know your earnings, tax deductions, and net income over a specific period. Read on to learn more about YTD real check stubs, how to read the information, and how you could benefit from them.

What Are YTD Real Check Stubs?

YTD real check stubs are check stubs that include data about your year-to-date earnings. The data on the check stub includes your gross income, total deductions, and net pay.

What Does YTD Mean on Check Stubs?

YTD means “year-to-date.” This phrase refers to the period from the beginning of your calendar/fiscal year to the current date.

For most organizations, the fiscal year is the same as the calendar year, meaning January 1 is the first day of the year. However, some private organizations alter their fiscal year to start and end at different times.

If your organization has a different fiscal year than the calendar year, you’ll need to know when it starts to better understand your YTD real check stub. For example, suppose your fiscal year begins on July 1. In that case, a YTD check stub issued on September 4 will only reflect July 1-September 4 rather than January 1-September 4.

To learn more about what YTD means, check out this article.

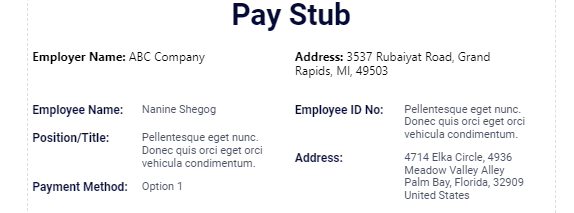

What Information Can I Find on My YTD Real Check Stub?

You’ll often find YTD data in a few forms on your check stub. Here are a few typical examples of what you might see on a personal YTD check stub:

- YTD Gross: Total earned since the beginning of the year

- YTD Deductions: Amount deducted from your check since the beginning of the year

- YTD Net Pay: Money (after taxes) you have received since the beginning of the year

Some YTD check stubs will include more information than just the items on the list above. For example, if you are paid by the hour, you will likely see a “YTD hours” section on your pay stub. This will reflect the total amount of hours you worked during the year. You might also see YTD data to reflect bonuses, overtime, or other pay you received during the year.

All YTD check stubs should consist of at least the gross income, deductions, and net pay. If yours doesn’t, you might want to look into an alternative service to provide your pay stubs.

Why Is YTD Data Useful?

YTD data is helpful for personal financial planning and for a more extensive analysis of company performance.

How Can Individuals Use YTD Data?

Individuals can use YTD data to better understand their financial situation and plan for the future.

Keeping track of how much money you are putting in your pocket in one calendar or fiscal year can give you a stronger sense of your financial outlook. This can let you plan an effective budget, improve your spending habits, and plan for large purchases in the future.

Luckily, you can easily track your YTD data by reviewing your check stub. If you need guidance understanding your check stub or finding this information, set up a time to chat with whoever runs payroll in your organization. They should be able to help you locate YTD on your check stub or provide you with the information in another form.

Outside of the information on your pay stub, YTD data is also a great way to track progress on your investments. You can calculate the YTD returns on your portfolios and use this data to make future investment decisions.

How Can Companies Use YTD Data?

Companies can use YTD data to analyze their performance and plan for the future. YTD data will not be something you use a pay stub to identify but should be tracked in other ways. Most accounting and bookkeeping software will allow you to view YTD data in many forms.

This data is most beneficially reviewed at least at the end of every quarter. Doing this will result in more awareness about how successful the company is and can help stakeholders make better decisions for the future.

At the very least, companies should review their YTD data at the end of the year to effectively plan and budget for the following year. Without analysis of where you are, it is difficult to get where you want to go. Regular analysis of YTD data can help you set concrete goals for your company and reach them.

Reviewing multiple years’ worth of data can help you identify trends that occur around the same time each year. For example, you might notice that your sales take a hit each year in the winter months. Once you know this, you can devise strategies to reverse the trend or mitigate the impact on the company.

Where Do You Get a YTD Real Check Stub?

Whether you are an individual employee or an employer, it’s essential to know where to find your YTD check stubs.

How Do I Get a YTD Real Check Stub From My Employer?

Your existing pay stub should already include YTD information. If you cannot find it or your pay stub does not include it, check with whoever runs payroll in your organization. They should be able to point you in the right direction or provide you with a YTD summary of your earnings.

How Do I Provide a YTD Real Check Stub To My Employee?

If you are an employer, you should provide YTD real check stubs to your employees by including this information on every paystub. Most check stub generator and payroll providers will allow you to add the YTDdata with just the click of a button.

Wrapping Up

YTD real check stubs provide information about employee earnings to help individuals better understand their financial situation and plan for the future. Companies can also benefit from YTD data analysis completed at the end of each quarter. You can find your YTD information on your regular paystub or request the information from whoever handles payroll in your organization.

- Why More Than One Admin Is Important for Brand Pages and How to Do It Right - February 5, 2026

- What to do if you think a doctor made a serious medical error - January 30, 2026

- What Makes a Brooklyn Car Accident Claim Strong? - January 30, 2026